Quick Answers

Pipe FAQs

Your questions answered

General

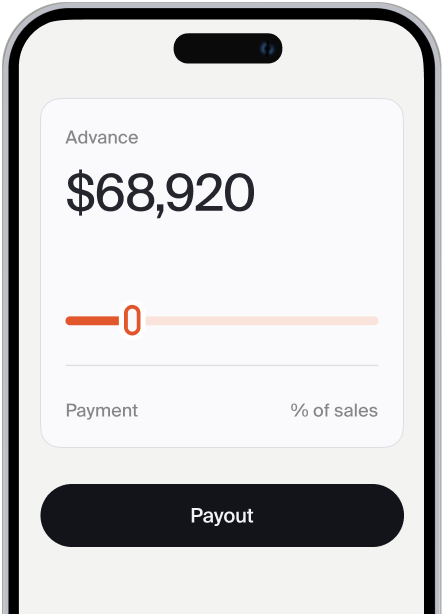

Pipe is a modern capital platform that enables companies to advance their revenue for up-front capital. For businesses, that means growth on your terms with more cash flow for scaling a company without dilution.

Pipe makes it simple to get fast access to capital based entirely on the health of your business, not who you know. Pipe’s underwriting uses your secure live revenue data, so you get the financing you truly deserve. Once approved, you can use as much of your offer as you need, and pay it back as a percentage of your revenue.

Pipe is built for companies of all shapes and sizes. Our unique underwriting system looks at a variety of data points in your banking and revenue information to get you the best possible terms. Businesses incorporated in the US that meet certain criteria, typically with at least $10,000+ annualized predictable revenue, may be eligible for a capital offer.

The best way to see what Pipe can do for your business is to go through our simple sign-up process. There's no cost to join Pipe and no obligation to use your offer once approved.

Rather than just a snapshot, we take a holistic view of your company using your revenue and bank data. Our algorithm reviews the overall health of your business, considers your historical performance, and even factors in projections of your future revenue.

Once the data is analyzed, you get a clear picture of the capital you're eligible for. Simply connect your revenue and bank data, and our system will quickly generate your initial offer details.

Your cost of capital will be a single flat fee that you pay back over time as a percentage of your future revenue. There are no compounding interest charges, requirements for personal collateral, or penalties for late payments when sales are slow.

Your fee is determined based on factors such as the health of your business, projected revenue, and sales volume and is calculated as a percentage of your advance amount. For example, if your fee is 10% on a $50,000 advance amount, then your fee will be $5,000.

We strive for transparency and simplicity in our pricing structure, so you know exactly what to expect. No surprises.

Your cost of capital on Pipe depends on your industry, revenue, and the health of your business. Over time, as your companies health improves, we can offer you even lower costs.

The easiest way to get your exact cost of capital is to go through our seamless, commitment-free sign-up process—it takes just a few minutes.

Our capital solution provides businesses with a quick and convenient way to access working capital in just a few steps, and unlike traditional methods, there’s no credit checks, personal guarantees, or extensive paperwork.

Here’s why businesses are choosing Pipe:

a. Streamlined process: Your offer is based on your live data, so once connected, all you need to do is submit your business and owner details, agree to the terms, and set up your payments. You can focus on running your business while we handle the funding process swiftly and smoothly.

b. Flexible Payments: Your payments are a percentage of your revenue so there are no fixed monthly costs and you’re never left in a tight spot when sales are slow. When you have a strong month you pay back more and when you have a slower month your payments shrink.

c. No personal guarantees: Unlike many other financial options, there are no personal covenants or guarantees. This means that you can access the capital you need without risking your personal assets or finances.

d. Fast access to capital: Once your payments are set up, we’ll send your capital the same day you request it, and depending on your bank, it can arrive in just a couple of hours! This eliminates the delays associated with traditional financing, helping you access capital when you need it most.

e. Dedicated support: Our team of experienced Revenue Managers is here to help with anything you might need! Reach out here, and we’ll be in touch soon.

No, there’s no cost to join Pipe, and no obligation to accept an offer once you have an account. Signing up takes just a few minutes. Securely connect your bank, billing, and accounting to find out how much capital you can access.

Once you’re approved and payments are set up, we’ll send your capital the same day you request it, and depending on your bank, it can arrive in just a couple of hours!

Onboarding

There are no credit checks, lengthy paperwork, or personal guarantees.

Connect: Connect your revenue and bank information through our secure integrations. You will be able to quickly find out how much capital you may be eligible for.

Verify details: Provide business details, a chosen business representative, and information on the business owners to verify your account.

Set up your Advance Payments Account *: Your ticket to effortless payments.

That’s it–once your revenue first hits your new account it verifies that your Advance Payments Account is set up and your capital will be on the way!

*Pipe Technologies Inc. is a financial technology company and is not a bank. Banking services provided by First Internet Bank of Indiana, Member FDIC.

Pipe is SOC 2 compliant and we use state-of-the-art standards to secure and protect your information, including bank-level AES 128-bit encryption. We limit sharing of any personal information with third-parties unless it is required for us to provide our services. For more info, check out our Privacy Policy. In addition, Pipe has a fully operational security team responsible for:

a. Risk assessment and vulnerability management across all internal and 3rd party systems

b. Enforcing strong Access Control Limits (ACLs) as well as Multi-Factor Authentication (MFA) to sensitive systems.

c. Threat Detection & Incident Response on call team, operating 24/7/365

Pipe’s algorithm assesses your risk level based on secure live data connections. More complete data connections typically mean better ratings and more capital available for your business.

In order to get the best offer possible, you need to sync your:

Accounting software

Billing or subscription manager

View-only business bank feed

Using a tool that won’t sync with Pipe? Don’t worry. We work with a wide range of software, but our team can also help you upload data by CSV if needed.

Once you connect your banking and revenue accounts you can expect to get initial terms in as little as a few minutes. To receive final approval, you will need to provide business and owner information so that we can complete our business verification process, which may be completed in as little as a few hours.

You can choose to advance as much or as little of your offer as you want until the offer expires. This makes it easy to just use what you need, when you need it, and only pay for the amount that you advance.

Contact us